Powell's Surprising Soft Tone Shocks Markets! Will GDP Boom or Bust Tomorrow? Click to Find Out!

Alright, folks, let's break it down!

Yesterday, the Fed raised interest rates by .25 basis points, which was totally expected by the money gurus. It's like they had it on their radar way before it even happened, and the lenders were already like, "Yeah, we saw that coming, no big deal!" So rates saw virtually no movement from the announcement.

But wait, the real drama happened during Fed chair Powell's press conference. He dropped some lines that made investors go all ears. Instead of the usual "Let's raise rates and keep 'em high!" stance, he said, "Hey, maybe we'll take a chill pill and see how things play out before hiking again." And guess what? The market went like, "Oooh, we like this softer tone, Mr. Powell, keep it coming!"

Buuut, today wasn't so peachy. There were these big reports on GDP, durable goods sales, and jobs, and they were all screaming strong! Sounds good, right? Nope! The market was like, "Hold on a sec, Fed's gonna take this as a sign to keep hiking those rates, and that's not good for us!"

Let's get geeky with those durable goods for a moment. Yeah, there was a spike in commercial aircraft sales, but that's not sustainable. That crazy number won't affect next month's stats. When we ignore those airplane shenanigans, the durable goods report shows only a teeny-tiny .06% increase. So, not as impressive as it may seem.

But hey, don't lose hope! We have two months of data before the next Fed meeting in September, and folks are crossing their fingers for declining inflation and better interest rates. Fingers crossed, everyone!

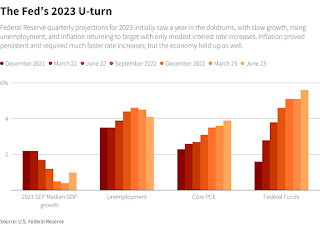

And here comes the big moment - tomorrow's PCE (personal consumption expenditure) report, the Fed's favorite measure of inflation. Brace yourselves, we're hoping the headline number drops from 3.8% to around 2.9%, and the core number (minus food and energy) goes from 4.6% to 4.1%. Still a bit higher than the Fed's 2% target, but progress, people! Let's hope for a market rally to make up for today's losses.

So, what's the Fed gonna do next? Keep an eye on the data! Tomorrow's PCE report, weekly jobs reports, and the CPI (consumer price index) report on August 10th will be our crystal ball. Let's see if the stars align or if we're in for some more rollercoaster rides! Keep calm and watch those numbers!

Comments

Post a Comment