The Truth About Down Payments for Tulsa Homebuyers

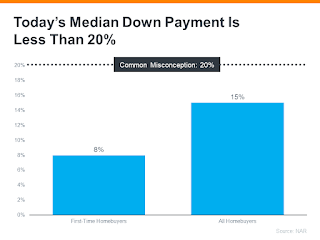

Many people believe that you need a 20% down payment to buy a home in Tulsa, but that's not always the case! While putting down 20% can help you avoid mortgage insurance, it's not a requirement. In fact, the median down payment for Tulsa homebuyers is only 15%, and it's even lower for first-time homebuyers at just 8%. So, why the misconception about the 20% down payment? It's a relic of the past! The median down payment hasn't been over 20% since 2005. Plus, there are many resources available to help you with your down payment, such as: Oklahoma-Specific Down Payment Assistance Programs Oklahoma Housing Finance Agency (OHFA): OHFA offers various down payment assistance programs that can provide grant funds or low-interest loans to help with your down payment and closing costs. Learn more at https://www.ohfa.org/homebuyers/downpayment/ REI Down Payment Assistance: REI Oklahoma partners with lenders to offer assistance with down payments and closing costs. They