Tulsa Mortgage Rates Reach a New 7-Month Low: Insights on Tulsa Home Loans

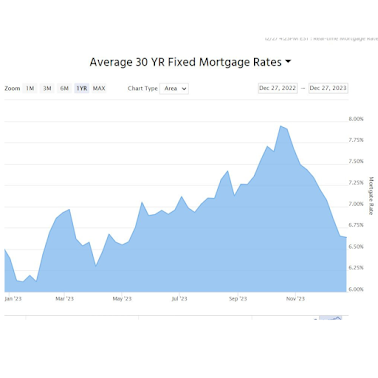

In the dynamic world of Tulsa mortgages, a significant yet subtle shift has occurred, marking a moment of stability in an otherwise fluctuating market. For the first time in a week, we've seen mortgage rates move by a normal amount, breaking the pattern of the calmest, flattest seven days in over a year. This stability, though not particularly headline-grabbing, is a noteworthy change for those interested in Tulsa home loans. Delving deeper into today's mortgage landscape, we find that Tulsa's mortgage rates have hit their lowest point since May 2023. This milestone is undoubtedly a positive sign for potential homeowners and those considering refinancing in Tulsa. While these rates are indeed the lowest in over seven months, it's important to note that the decrease is not significantly lower than what we've observed in the past two weeks. Essentially, the average mortgage borrower would likely receive a similar quote today as they would have on other recent days.