**Breaking: Market Turmoil! Is a Major Reset Imminent?** - Daily Update, August 24, 2023

We find ourselves on the cusp of a significant market reset following recent turmoil caused by investors shorting mortgage-backed securities. To provide some clarity, when investors take a short position, they essentially bet on the failure of a security. In this case, the focus is on mortgage-backed securities, and as these securities approach predefined levels, many investors are poised to reinvest in them.

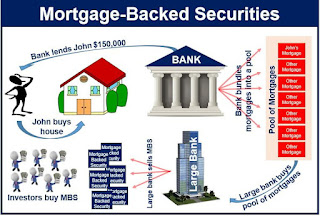

(Here is a graphic explaining what mortgage-backed securities are and how they are created)

This potential influx of reinvestment holds the power to invigorate the markets and potentially lead to a decrease in interest rates. However, our optimism is tempered by this morning's robust jobless claims report, signaling potential economic challenges ahead. Adding to this, tomorrow's address by Federal Reserve Chair Powell, set against the backdrop of the Jackson Hole summit meeting, is expected to shed light on the Fed's upcoming strategies. Should Powell hint at the need to further raise rates due to the economy's sustained strength, we could be navigating uncharted waters. This scenario might contribute to a continued decline in mortgage-backed securities, subsequently pushing interest rates higher.

Navigating investment charts involves recognizing two critical levels: the ceiling and the floor. Presently, our position is below the 20-year floor, leaving us to contemplate whether a rebound is on the horizon or if we're on a trajectory not witnessed since the 1980s.

Stay tuned for more updates as these dynamic market forces continue to unfold. Remember, in the world of finance, preparedness and adaptability are key.

Click here to schedule a phone chat with me to discuss more or call/text me at 918-361-1550!

Comments

Post a Comment