Riding the Rate Rollercoaster: Is the Market Pranking Us by Raising Rates?

Picture this: remember that big financial mess back in the day called the Great Financial Crisis (GFC)? Well, that totally changed how we see things in the money world. Back in the disco era (the 70s and 80s), interest rates were like a lazy river, just chilling at 1-3%. Then COVID came along, threw a tantrum, and rates started acting like a rollercoaster. It's been a bit of a shocker for us.

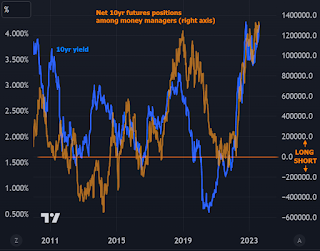

Now, imagine this: some smarty-pants folks think that 4.3% interest rates for a

10-year loan is way too high, and they thought buyers would be lining up for

cheaper deals. But guess what? When lots of folks are all betting on one thing,

the market tends to flip the script on them.

Think of it like this classic saying: "The market does the opposite just

to make traders scratch their heads." But peek behind the scenes, and

you'll see something funny. Big money managers (they're the ones playing with

10-year loans) really like high interest rates. The higher, the better, according

to them.

Sure, they're making bigger bets now than they have in a while, but that's not

much different from the end of 2018. And hey, back in 2015, they were making

huge bets too, and guess what? The market went, "Nah, I'm good," and

bonds got super cheap.

Now, hold on, there's a bunch of other folks who think bonds are a bad deal. These risk-takers called leveraged accounts have made a whole lot of bets against bonds, enough to cancel out the big bets the money managers are making.

Bottom line, my friends: don't believe everything you hear about the market's habits. Bonds are all tangled up in a new way of life, thanks to shorter-term interest rates acting like puppets to the Fed's plans. Also, Uncle Sam's been printing a lot of money, so he's selling lots of IOUs, and foreign governments are selling their own IOUs too to fix their money problems.

Here's the kicker: until the short-term interest rates take a big dip, the long-term ones won't get a break. But the Fed won't hit the brakes until they see inflation and the economy take a nosedive. For inflation, it's like repeating a cool trick, and for the economy, things need to start looking real gloomy.

So, remember, the money world is a quirky rollercoaster, and it loves playing pranks on those who think they've got it all figured out!🎢

Want to chat with me about the market and where I think it's going, when is the best time to lock rates if you're in the market? Book a phone call with me here.

Comments

Post a Comment