Unlock the Secrets: How Interest Rates Are Influenced, Where They're Heading, and Should I Wait to Buy?

Should I wait to buy a house?

What are interest rates going to do?

First, let me say that I completely understand your hesitancy. With high interest rates and soaring house prices, anyone could argue that it seems like a terrible time to buy a house. However, let's set aside opinions and focus on some facts.

To predict where interest rates are headed, we need to look at their past behavior and reasons. In history, interest rates mostly followed inflation, except for temporary cases. Why is there inflation now? It is estimated that COVID caused $14 trillion in economic damage to our country. Putting so much money into the economy leads to inflation for years. While this might oversimplify the problem, it's a big reason. Printing lots of money makes things cost more and reduces the dollar's value.

Healthy inflation is beneficial. Historically, during our strongest economic periods, inflation hovers around 2%, which the fed aims for. This target indicates robust and steady annual growth. Generally, with 2% inflation, personal income rises sufficiently to match living costs, resulting in contentment.

In such economic times, interest rates vary between 4.5% and 5%. So, when we return to a standard economy, these are the anticipated interest rates. The question isn't if, but when. Throughout history, these cyclical patterns are consistent across all economies. It's an inevitable progression. (Feel free to contact me for tools to monitor inflation if you're interested in learning more about this topic.)

Why do interest rates follow inflation? Let’s break it down with an analogy:

Imagine Sam and Bob as players in a financial game. Sam's goal is to buy a car worth $30,000, and he's been diligently saving up for it. Bob, however, faces unexpected financial difficulties and turns to Sam for a loan of $30,000. To ensure Sam can still afford the car in five years, they must try and anticipate what the cost of the car will be then. Predicting the exact price of the car in five years is challenging, so Sam and Bob settle on a repayment amount of, say, $32,000 or $33,000. This extra money isn't just about securing the car; it's also about compensating Sam for postponing his car acquisition and making the loan worthwhile.

This scenario mirrors how lenders and borrowers interact. When someone seeks a loan from investors, they are essentially negotiating the future value of borrowed money. This is particularly relevant in the context of mortgage interest rates. Over a 30-year mortgage, lenders consider how inflation influences the future worth of the repaid dollar. If the general cost of goods and services rises, lenders anticipate that the dollar repaid down the line will be less valuable. To account for this, they adjust interest rates to reflect the projected inflation, ensuring they're adequately compensated for the lending risk and the potential decline in purchasing power over time.

All right now that we’ve established why interest rates are high, and where they are going long-term in a healthy and stable economy. Let’s talk about the housing market.

Every day, I meet people who say they'll wait for a crash before buying a house. The only crash we've seen was in 2008, so it's important to understand why it happened. I remember buying my first house in 2004. I had no significant income to report and just a driver's license. I didn't put any money down and borrowed all the closing costs. It took only a few minutes with the mortgage broker to close on a $250,000 house that I probably shouldn't have bought. Technically, I could have bought 10 houses like that and the bank would have allowed it (many people did). If you've applied for a mortgage in the last 15 years, you'll know things are very different now. So, there's no need to dwell on this topic. If you're curious about how things were in the past, you might want to watch "The Big Short."

Despite the significant differences in mortgage regulations and qualifications nowadays, these nuances represent minor details in the overall story.

The main driver of the housing market is the simple concept seen in all buying and selling: supply and demand.

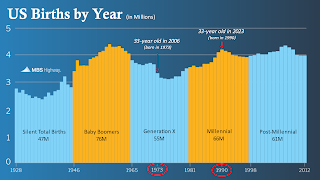

Let's examine housing formations (demand) versus housing starts or construction (supply). A home is typically "formed" through marriage, with women marrying around 27.4 and men around 29.5 years old. First-time homebuyers are usually between 33 and 36 years old. Comparing birth rates 30-40 years ago to those before the 2008 housing crash reveals an upward trend. Birth rates increased steadily from the late 70s through the 80s (Gen X) and surged further in the 90s and early 2000s (millennials). This isn't an opinion, but an established fact: more 30 to 40-year-olds exist today than ever before. In essence, this translates to increased housing demand.

Now, let's examine the supply. In 2007, there were over 4 million homes listed for sale in the US. As of July 2023, there are currently approximately 1.08 million homes listed on the MLS for sale. Among these, 460,000 are under contract, leaving just over 600,000 available for purchase.

But what about all the builders building houses? Well in 2006 almost 2,000,000 new homes were built (supply) and there were less than 1000,000 housing formations (demand). Compare that to 2020, where they were over 1.6 million housing formations and around 1.2 million housing completions. Similar shortages year over year have lead to the demand outgrowing the supply by the millions (see the chart below for years 2004-2023 completions verse formations). This makes the case for a very strong housing market for the foreseeable future.

What does this mean for you right now? This offers a short window of opportunity, maybe the best in the last five years and possibly the best we'll see in the next five. Why is this important? Because you can buy a home at a lower price today because people are worried about high interest rates. It's predicted that interest rates will go down a lot in 2024, and when that happens, home prices usually go up.

(this graphic shows why you should never bet against the real estate market! We are NOT in a housing bubble. You are more than likely making a good bet by getting into the market, even with higher interest rates!)

Just remember, you can refinance a 7% interest rate later, but you'll always be stuck with the extra $20,000, $30,000, and $50,000 you will likely pay for a house when everyone starts competing for them again.

Don't wait any longer – call your lender and realtor today! Real estate is a better bet than stocks, bonds, or any other investment. Put your money where it counts and take advantage of this opportunity! Click here to book a phone chat with me today.

Comments

Post a Comment