Optimistic Market Update: Potential Recession Avoided & Key Insights - Sept 2023

What Happened in the Recent Federal Meeting?

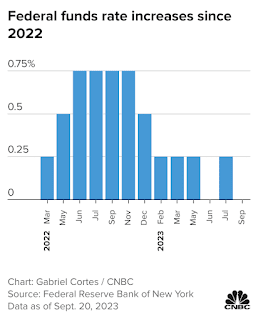

- In the recent Federal meeting in September 2023, there were no changes made to the main interest rate (Fed funds rate). It remains between 5.25% and 5.50%.

- Everyone was expecting this decision, so no surprises there.

- The main insights from the meeting will come from the Economic Projections summary and the press conference by Chair Powell.

Why Does This Matter?

- Any changes in the Federal statements can impact the bond market. For example, if the Federal Reserve sounds more aggressive about controlling inflation, it could lead to higher bond yields.

- This summary will give us an idea about future rate changes. It will tell us if rates might go up again or when they might be reduced.

What's the Current Market Situation?

- The economy is doing well, and there's a chance we might avoid a recession.

- However, there's been a recent increase in inflation. This has made everyone watchful about how the Federal Reserve might react.

- Before the next Federal meeting on November 1, several factors will influence rate expectations, like rising gas prices, China's economic health, potential government shutdowns, and more.

How Does This Affect the Mortgage Market?

- The mortgage rate market is unpredictable right now. Rates change daily, and there's a lot of uncertainty.

- This uncertainty is also affecting the number of new mortgages being originated.

Advice for Homebuyers:

- The housing market is still competitive with limited homes available.

- If you find a home you love and your offer is accepted, it's wise to secure your mortgage quickly. This will help you avoid any sudden rate changes that could disrupt your plans.

In Short: The Federal Reserve has kept rates steady, but the mortgage market remains unpredictable. If you're looking to buy a home, act fast to secure your mortgage rate.

Click here to book a phone chat with me

Or click my signature box below to get started.

Comments

Post a Comment