The Future of the Federal Funds Rate & Mortgage Rates Insights

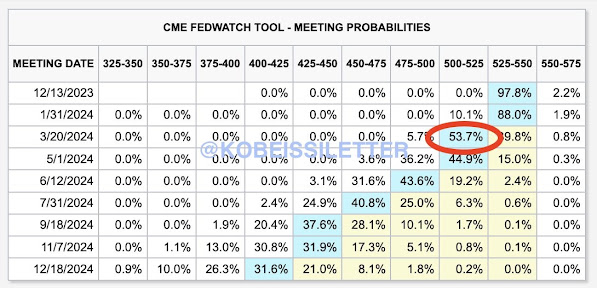

As we pore over the color-coded probabilities from the latest CME FedWatch Tool, a pattern emerges that hints at the anticipated trajectory of the Federal Reserve's interest rate decisions. The blue highlighted boxes serve as a beacon, illuminating where a consensus of experts predicts the fed funds rate will land at upcoming Federal Open Market Committee (FOMC) meetings.

The CME FedWatch Tool is a visual representation of market sentiment and expectations regarding FOMC decisions. The blue highlights draw our attention to the ranges with the highest probabilities, effectively a collective bet by market participants on where the fed funds rate is most likely to settle.

March 2024: A Turning Point

A significant takeaway from the tool is the strong belief among experts that starting in March 2024, we will witness a pivotal shift. The probabilities lean toward a decrease in the fed funds rate, as indicated by the blue hues shading lower rate intervals for that meeting and subsequent ones.

The Fed Rate and Mortgage Rates: An Inextricable Link

The fed funds rate is often viewed as the heartbeat of the financial sector, setting the rhythm for other interest rates across the country, including mortgage rates. Banks and lending institutions look to the fed rate as a guide, adjusting their lending rates to align with changes made by the Federal Reserve. A lower fed rate generally means lower mortgage rates, and vice versa.

Implications for the Mortgage Market

If the expert predictions prove accurate, we're looking at a potential softening of mortgage rates in the future. For prospective homebuyers, this could mean more affordable borrowing costs and an opportunity to secure home loans at more advantageous rates. For current homeowners, the shift may present a chance to refinance existing mortgages, potentially reducing monthly payments and overall interest paid over the life of the loan.

A Look Ahead

As we edge closer to these key dates, it's crucial for market watchers and homebuyers to remain vigilant. The FedWatch Tool's insights are not guarantees, but they provide a valuable gauge of market sentiment. Those with an interest in the mortgage market should stay informed and prepared to act, as the predicted changes could herald a more favorable lending landscape.

Stay tuned for updates as we track these developments and their potential impact on the mortgage market.

For more insights and updates on the financial market, subscribe to our newsletter and never miss an important trend. Or click here to book a phone consultation with us so we can discuss the best next steps!

Comments

Post a Comment