Homeownership as a Wealth Strategy: A Tulsa Perspective

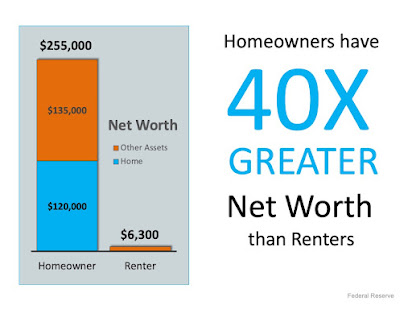

Every three years, the Federal Reserve’s Survey of Consumer Finances offers a window into the financial health of American households. The stark contrast between the net worth of homeowners versus renters is a testament to the power of real estate as an investment. In Tulsa, the trend follows the national narrative: homeownership remains a robust pillar of personal wealth.

Tulsa Mortgage: The First Step Towards Financial Growth

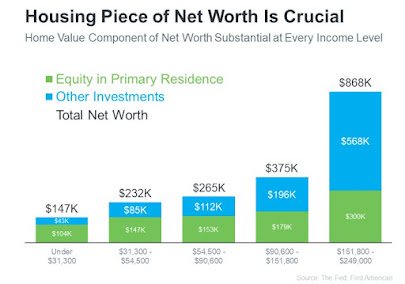

A Tulsa home loan is not just a debt; it's an investment into one's future. The equity accrued in a primary residence represents the largest share of most homeowners' net worth. Tulsa's competitive mortgage rates and diverse property market make it an ideal locale for buyers seeking to leverage homeownership for wealth accumulation.

The Home Equity Effect on Tulsa's Homeowners

In Tulsa, as in the rest of the country, home equity stands out as a significant contributor to net worth across all income brackets. This is particularly compelling in the context of Tulsa mortgage options, which facilitate the journey towards building substantial equity.

A Local Real Estate Agent: Your Guide to Tulsa's Market

Navigating Tulsa's real estate market, with its myriad of home loan options, can be daunting. Local real estate agents provide invaluable insights, guiding buyers to make informed decisions that align with their wealth-building goals.

Building Net Worth in Tulsa: The Homeownership Advantage

The correlation between homeownership and net worth is undeniable. In Tulsa, this principle holds true, offering an opportunity for residents to engage with the real estate market strategically to enhance their financial standing.

Conclusion: A Wealth of Opportunities in Tulsa Homeownership

Tulsa's real estate market presents a plethora of avenues for potential homeowners to increase their net worth. Whether it's through securing a favorable Tulsa home loan or capitalizing on property appreciation, the path to financial prosperity is clear. Contact us today by clicking below to discuss your next steps. Or click here to book a quick phone chat with us.

Comments

Post a Comment