The Truth About Down Payments for Tulsa Homebuyers

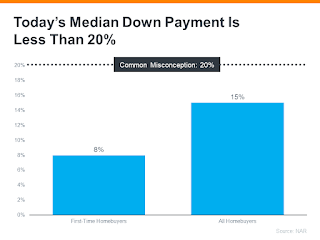

Many people believe that you need a 20% down payment to buy a home in Tulsa, but that's not always the case!

While putting down 20% can help you avoid mortgage insurance, it's not a requirement. In fact, the median down payment for Tulsa homebuyers is only 15%, and it's even lower for first-time homebuyers at just 8%.

So, why the misconception about the 20% down payment?

It's a relic of the past! The median down payment hasn't been over 20% since 2005. Plus, there are many resources available to help you with your down payment, such as:

Oklahoma-Specific Down Payment Assistance Programs

Oklahoma Housing Finance Agency (OHFA): OHFA offers various down payment assistance programs that can provide grant funds or low-interest loans to help with your down payment and closing costs. Learn more at https://www.ohfa.org/homebuyers/downpayment/

REI Down Payment Assistance: REI Oklahoma partners with lenders to offer assistance with down payments and closing costs. They can help you determine your eligibility and guide you through the process. Find out more at https://www.reiok.org/programs/rei-down-payment/

- FHA loans: These loans allow you to put down as little as 3.5%.

- VA loans: If you're a veteran, you may be able to qualify for a VA loan with no down payment required.

- USDA loans: These loans are available for qualified buyers in rural areas and require no down payment.

Don't let the down payment hold you back from your dream of homeownership.

If you're ready to buy a home in Tulsa, don't wait until you have 20% saved up. Contact me today to learn more about your options and get started with the mortgage pre-approval process. With Tulsa mortgage rates at near-historic lows, there's no better time to buy a home!

I'm here to help you make your homebuying dreams a reality.

Contact Mike David, your Tulsa mortgage lender, today: 918-361-1550 call or text!

Not ready to apply yet, click here to book a phone consultation with Oklahoma Mortgage Group so we can answer any questions you have and discuss best next steps!

Comments

Post a Comment