The Cost of Waiting: Why Tulsa First-Time Homebuyers Should Act Now

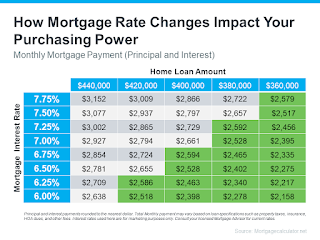

The dream of homeownership is more than just an American staple—it's a stepping stone to financial stability and wealth-building. In Tulsa, where the market is ripe with opportunity, taking the leap can seem daunting. However, the Oklahoma Mortgage Group (OMG) is dedicated to transforming hesitation into action, especially for Tulsa first-time homebuyers. Tulsa's Housing Market: A Goldmine for Growth Real estate in Tulsa has been a spectacle of appreciation. Imagine purchasing a home in Oklahoma for $200,000, only to find its value surging over 51% in five years to $302,000! This isn't just a dream—it's the reality Tulsa homeowners have been living. Now, with Tulsa mortgage rates poised to decline, the question isn't if you should buy, but why haven't you already? Interest Rates and Your Future Sure, renting seems convenient, with no maintenance woes or property taxes. But it's a silent killer for your finances. With average rents climbing, a renter could sp...