Tulsa Mortgage Market Update: Interest Rates Showing Signs of Stabilization

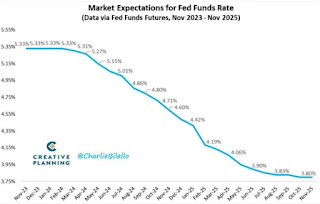

If you're keeping track of the Tulsa mortgage market or are a realtor in the Tulsa area, today's update from Federal Reserve Chairman Powell is particularly relevant. Understanding the movement of mortgage rates is crucial, especially in the Tulsa market. Powell's recent speech provided some key insights, indicating a potentially stable period ahead for mortgage rates. Here's a simplified breakdown of the key points: - The yield on 10-year Treasury notes, a significant indicator for Tulsa mortgage rates, has decreased to 4.01%. - Mortgage-backed securities, closely tied to Tulsa mortgage rates, have seen a notable increase in value. Let's delve into Powell's speech to understand its implications for the Tulsa mortgage market: 1.Policy Tightening : The Federal Reserve is open to increasing rates if necessary, but the current outlook suggests stability. 2. Interest Rate Peak : It appears that the interest rates, a key factor for Tulsa mortgages, might have reached...