The Latest on Federal Funds Rate: What to Expect through 2023 and Beyond

If you're keeping a keen eye on the Federal Funds Rate, you're in for some interesting developments in the coming years. Here's what's on the horizon:

The Pause Button is On

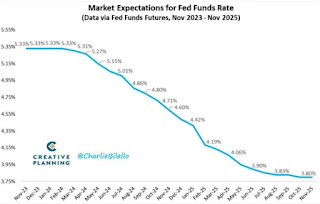

First things first, mark your calendars for Dec 13, 2023, Jan 31, 2024, and Mar 20, 2024. Why? Because the Federal Reserve is hitting the pause button on these dates. That's right, no rate hikes or cuts. It's a time to take a breather and see how the economic winds are blowing.

Trimming Down on May 1, 2024

Fast forward to May 1, 2024, and there's a small but significant change coming. The Federal Reserve plans a slight trim of 0.25%, bringing the Federal Funds Rate to a comfortable range of 5.00-5.25%. This move signals a cautious but optimistic approach towards managing the economy.

Looking Ahead to November 2025

Peering further into the future, by November 2025, there's an anticipation of further reductions. The Federal Funds Rate is expected to cool down to a chill 3.80%. It's a gradual descent, indicating a long-term strategy to foster stable economic growth.

What This Means for Your Mortgage

Now, it's crucial to understand that these figures aren't what you'll see on your mortgage statement. Consumer rates generally sit at a higher level compared to the Federal Funds Rate. But don't let that dampen your spirits. The good news is mortgage rates are also expected to follow a downward trajectory in 2024 and 2025.

To Wait or Not to Wait?

So, you might be thinking of playing the waiting game for a lower mortgage rate. Here's something to consider: a dip in mortgage rates could open the floodgates to a flurry of buyers. This increased demand could push home prices up, and with more buyers in the market, expect more competition for your dream home.

The Savvy Move

The smart strategy? Consider buying a home at today's prices. Then, when the rates drop, refinance your mortgage. It's like grabbing the perfect parking spot and then getting your parking validated. You secure the asset at a good price and get the benefit of lower rates later. Total win-win!

In Conclusion

The Federal Funds Rate is set for some interesting twists and turns in the coming years. While it directly impacts the economy, its indirect effects on mortgage rates and the housing market are equally significant. Staying informed and strategizing accordingly can help you make the most of these changes. Click here to book a phone chat with us here at the Oklahoma Mortgage Group so we can advise you on the best next steps.

Comments

Post a Comment