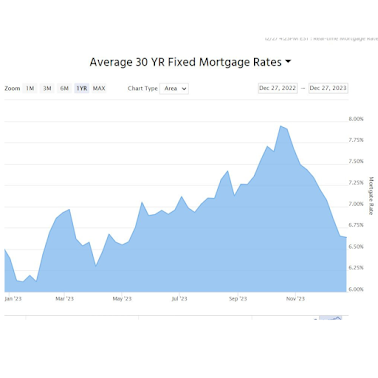

Two Factors that Influence Mortgage Rates

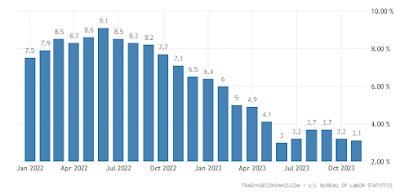

As potential homeowners in Tulsa keenly observe the ever-evolving mortgage landscape, understanding the dynamics of Tulsa mortgage rates becomes paramount. In recent years, we've witnessed these rates plunge to historic lows, surge significantly, and now, they're beginning to retreat slightly. But what drives these fluctuations? The factors at play are multifaceted and intricate, with inflation, the Federal Reserve's strategies, and the 10-Year Treasury Yield playing pivotal roles. Inflation and the Federal Reserve's Influence While the Federal Reserve (commonly referred to as the Fed) doesn't set mortgage rates directly, its actions profoundly impact them. The Fed maneuvers the Federal Funds Rate in reaction to various economic indicators such as inflation, the overall economic climate, and employment statistics. As the Federal Funds Rate shifts, Tulsa mortgage rates tend to follow suit. During recent years marked by heightened inflation, the Fed escalated the Fede...