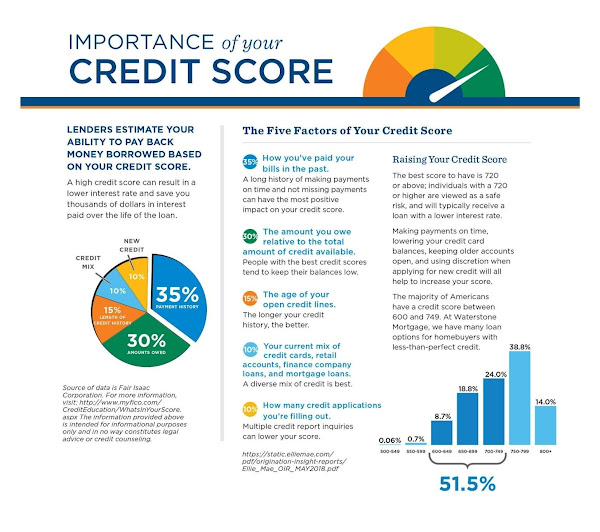

What Tulsa Homebuyers Need to Know About Credit Scores

A strong credit score is vital in the Tulsa mortgage process. It's essential for securing Tulsa home loans at competitive rates. Your credit score is a metric used by Tulsa mortgage lenders to gauge your ability to repay borrowed money. Here's what every Tulsa homebuyer should know about the components of a credit score: The Five Factors of Your Credit Score: Payment History (35%) : This is about how consistently you've paid bills on time in the past. Maintaining a record of prompt payments is the most beneficial way to boost your score. Amounts Owed (30%) : It's crucial to manage the amounts you owe in relation to your total credit limit. Keeping low balances relative to your credit availability is key. Length of Credit History (15%) : The length of time you’ve had credit goes a long way. A longer credit history can positively impact your score. New Credit (10%) : Opening multiple new credit lines in a short period can be seen as riskier by lenders. It's advisable