Why Owning Tulsa Homes is Your Key to Financial Prosperity - A Perspective from Oklahoma Mortgage Group

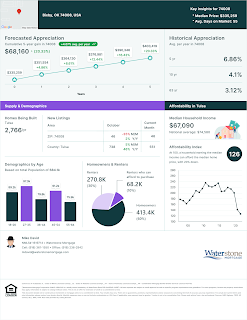

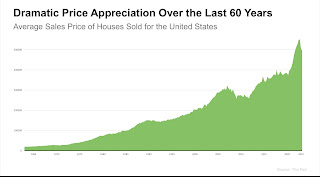

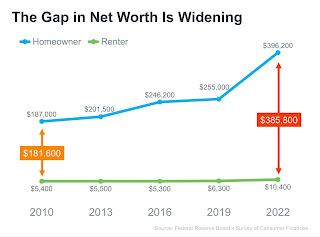

In the ever-evolving economic landscape of 2023, the importance of making wise financial decisions has never been more critical. A striking statistic has surfaced, highlighting a significant disparity in net worth between homeowners and renters. In 2022, homeowners had an average net worth of $396,000 compared to a mere $10,400 for renters. This means that homeowners had over 40 times the net worth of those who rent. This gap underscores a crucial point: the power of owning a home, especially in vibrant communities like Tulsa, Oklahoma. Homeownership: A Step Towards Wealth Building Homeownership is not just about having a place to call your own; it's a vital investment in your financial future. Every mortgage payment made towards your Tulsa home is a step closer to enhancing your wealth. Unlike rent payments, which contribute to someone else's financial goals, mortgage payments build equity in your property, increasing your net worth over time. The Tulsa Advantage Tulsa, Oklaho...