Why Experience Matters When Choosing a Mortgage Lender

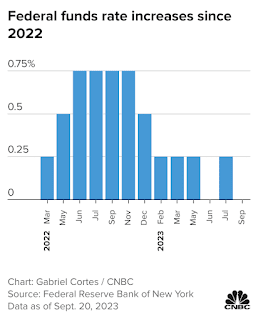

In these pressing times with higher interest rates and scarce inventory, gambling on an inexperienced lender is risky! When the stakes are high, you need a trusted partner like Oklahoma Mortgage Group! 🌿 Precedent in Lending: In law, precedence is key to resolving new cases. Likewise in lending, a history of successful closings provides a blueprint for approving new, similar applications confidently and creatively. 🚀 Oklahoma Mortgage Group Advantage: - 1,000+ Successful Closings : Drawing from over 1,000 loans closed in the past 3 years, we don’t just rely on theory; we have practical, proven experience and a multitude of ‘precedents’ to draw upon to secure approvals, ensuring your clients enjoy a smoother, assured approval process. - 275+ new applications just in the last 3 months! Each one meticulously scrutinized, ensuring a path to approval is not just found, but masterfully crafted. - Expert Team : Our team, with 40 years of in-house processing experie...